Looking for mortgage loan calculator The mortgage covers a lot of aspects, including tenure, loan amount, repayment, interest rates, fees, etc. And if you want to deeply understand how each of these aspects can affect your finances, it is highly recommended to use a mortgage loan calculator. Loan calculators not only help in educating you, but these are also best in saving your valuable time while you are dealing with the mortgage lender.

How much loan?

Depending on your current and future finances and mortgage finance, with the help of loan calculators, you can easily determine the amount of loan that you will be eligible for. You can also check the monthly installments for the loan that you will take as well as you are also allowed to check with the help of a calculator whether or not you can make such payments.

What form of loan?

The most common form mortgages are interest-only mortgages and fixed rates. As a fixed-rate mortgage repays over time, the interest-only mortgages merely require you to pay just the portion of interest on the loan. And each of these leans involves different calculations regarding your monthly outflows, and therefore using loan calculators helps you to know which the most suitable one is and which is the best mortgage rates.

Which Mortgage Lender?

With the help of loan calculators, you are able to compare the interest rates, monthly instalment amounts, costs, fees, and the amounts that are to be paid among different lenders. Therefore, with the help of these calculators, you are able to choose the most suitable and best lender as well.

How much equity?

Normally, the majority of lenders tend to lend up to 80% of the property value, and the rest of the balance of 20% will be put in the equity. By making use of loan calculators, you will come to know the amount which is required as your equity. Thus, you will be able to plan your finances easily.

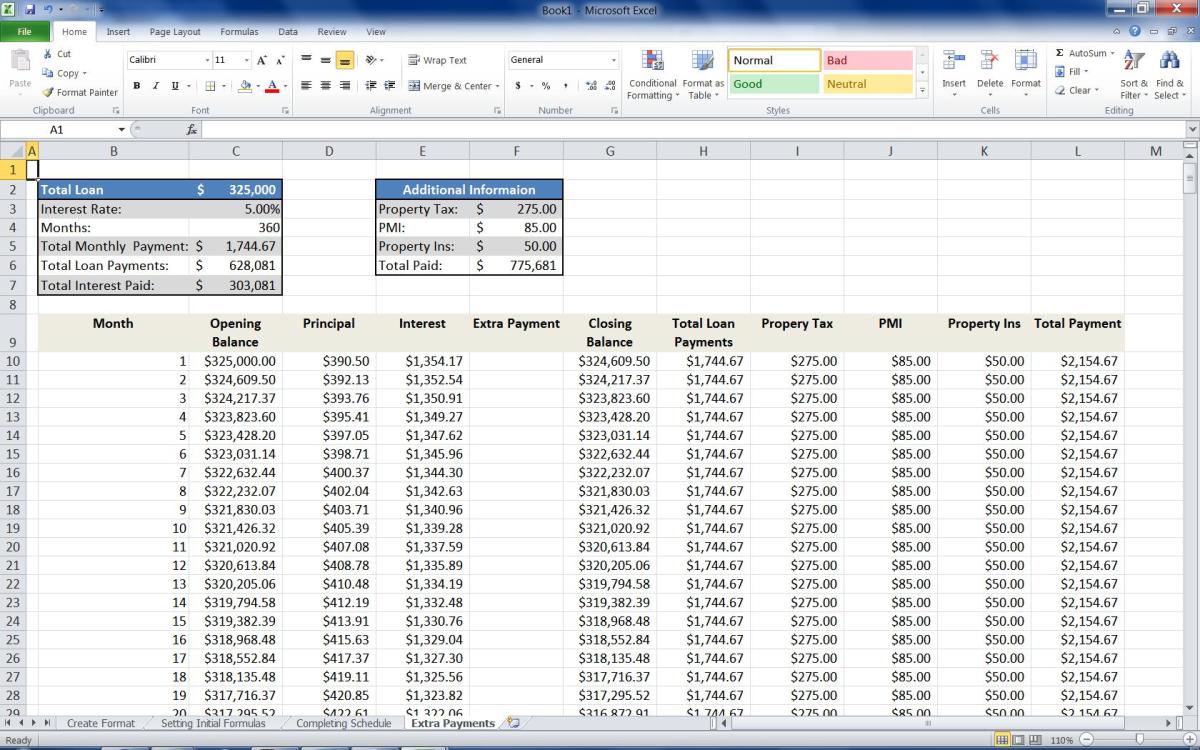

Mortgage Loan Calculator:

Using these calculators is quite easy and simple. In these calculators, you are just required to fill in the loan amount, which is required along with the amortization tenure and interest rate. And after you minus the equity from your home value, you will come to know the loan amount, amortization tenure, along with the interest rate, which you can effortlessly obtain from various lender sites.

Based on the above-mentioned detailing, you will get the estimated monthly payments with the help of a mortgage loan calculator to serve your mortgage.